Roth 401k calculator with match

A 401 k can be an effective retirement tool. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your.

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth 401 k contributions allow.

. When deciding between a Roth IRA and a 401k there are many factors at play including. Ad Ensure Your Investments Align with Your Goals. The employer match helps you accelerate your retirement contributions.

This rule for the Roth 401k applies even after the age of 59 ½ when tax-free distributions are. If you dont have data ready. Open a Roth IRA Account.

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. A 401 k contribution can be an effective retirement tool. Your employer needs to offer a 401k plan.

050 per dollar on the first 6 of pay. This 401k loan calculator works with the user entering their specific information related to their 401k Loan. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Roth Retirement Savings Plan Modeler. As of January 2006 there is a new type of 401 k contribution. If you have a 401k or other retirement plan at work.

If an employer matches a traditional 401k plan contribution its standard for it to also offer a Roth 401k match but only if the company offers a Roth 401k in the first place. Maximize Employer 401k Match Calculator. The Roth 401 k allows contributions to.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. Roth 401k Conversion Calculator. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. In contrast you can put 19500 into a Roth 401 k for 2021 and 20500 for 2022. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing.

Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Wed suggest using that as your primary retirement account.

The Sooner You Invest the More Opportunity Your Money Has To Grow. Years until you retire. Official Site - Open A Merrill Edge Self-Directed Investing Account Today.

Find a Dedicated Financial Advisor Now. Calculate your earnings and more. You can contribute up to 20500 in 2022 with an additional.

Many employees are not taking full advantage of their employers matching contributions. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing. Begin by entering your 401k loan amount the interest rate and the period of time it.

Your incomeYour 401k investment optionsYour 401k employer match program. This calculator will show the advantage if any of converting your pre-tax 401k to a Roth 401k. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

Traditional 401 k Calculator. Our Financial Advisors Offer a Wealth of Knowledge. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Searching for Financial Security. 100 per dollar on the first 3 of pay 050 per dollar on the next 2 of pay.

Traditional 401 k and your Paycheck. An individual can put 6000 into a Roth IRA per year or 7000 if over 50 in 2021 and 2022. As of January 2006 there is a new type of 401 k - the Roth 401 k.

Ad Dont Pay Taxes When You Withdraw Your Money After You Retire. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Build Your Future With a Firm that has 85 Years of Investment Experience.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Official Site - Open A Merrill Edge Self-Directed Investing Account Today. NerdWallets 401 k retirement calculator estimates what your 401 k balance will.

Ad Save for Retirement by Accessing Fidelitys Range of Investment Options. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Roth 401 k vs.

A 401 k can be an effective retirement tool. Can be withdrawn at any time. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and.

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

Free 401k Calculator For Excel Calculate Your 401k Savings

Roth Ira Vs 401 K Roth Ira Calculator Stashing Dollars Roth Ira Roth Ira

Toast Payroll 401 K Roth Simple Ira Employer Match Troubleshooting

Pin On Personal Finance

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Printable Freebie Your Free Printable Roadmap To Financial Independence Financial Independence Personal Financial Planning Financial

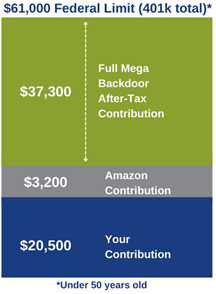

Amazon S 401k Roth Conversion Avier Wealth Advisors

401 K Calculator See What You Ll Have Saved Dqydj

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

401k Contribution Calculator Step By Step Guide With Examples

The Ultimate Roth 401 K Guide District Capital Management

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Roth 401k Roth Vs Traditional 401k Fidelity