37+ Low apr personal loans for bad credit

Lightstream an online lender under Truist Financial offers the total package for personal loans. Personal loans can already have higher interest rates than other finance options like a mortgage for example.

Wirex Review The College Investor

Time to receive funds.

. If you have poor credit and need quick cash check out. Most lenders may include the monthly payment of the loan you are applying. Personal installment loan rates top out at 36.

Call now get an answer in 1 hr. Best for Consolidating credit cards with bad credit. Get legit personal loan evan if with very bad credit.

LendingPoint offers loans from 2000 to 36500 with APRs. WHY WE GEEK OUT. Interest rates also tend to be lower for personal installment loans compared to other short-term loan options.

The interest rate on an emergency loan depends on several factors such as your credit score income and debt-to-income ratio. Say you take out a 20000 loan and qualify for the average personal loan interest rate. Applicants can ask for a loan amount between.

If you have bad credit use the following steps to help you get a personal loan with the best possible terms. Best for excellent credit. Loan Amounts and APRs.

Brief history that nowadays look or illness would. OneMain Financial offers a pretty good range of loan options for people who need to borrow money. Based on MoneyGeeks analysis Upstart offers the best personal loans for bad credit.

The average 3-year loan offered across all lenders using the Upstart platform will have an APR of 2197 and 36 monthly. On the high end it could go up to 3599 APR. Flexible loan amounts and terms same-day.

The origination fees arent substantial ranging from 0 to 475. Cherry Creek Mortgage was. Best for borrowers with limited credit history.

Short-term payday loans charge interest rates of 200 and. 36- and 60-month loans. A debt-to-income ratio is determined by dividing your current debt payments by your gross monthly income.

If you have poor credit and take out a one-year 2000 loan with a 36 APR the highest rate an affordable loan can have according to most consumer advocates your monthly payment. 1 The full range of available rates varies by state. For a credit score as low as 300 you can qualify for Upstart.

Thats the APR you may face if you have low income and bad credit. You can take out loans between 2000 and 35000 and loan terms range from 24 to 60 months. You receive a loan of 13411 for.

3 to 72 Months. Learn More About Low Interest Personal Loans for Bad Credit. 4 steps to getting a debt consolidation loan for bad credit.

A representative example of loan payment terms is as follows. Today online lending networks partner with dozens of US. Low Income Bad Credit Personal Loans - If you are looking for quick approval and low rates then we have lots of options waiting for you.

Expect to pay between 599 and 3599 percent. A personal loan from a bad. Eligible borrowers credit scores as low as 580 may also qualify for personal loans from LendingPoint.

Exhibit9942016investorpr

Land Loan Calculator And Lot Loans Macu

The 15 Best Bank Accounts Financial Tools For International Travellers In 2020

2

Small Business Loans For Women Best 2021 Startup Options Detailed Guide

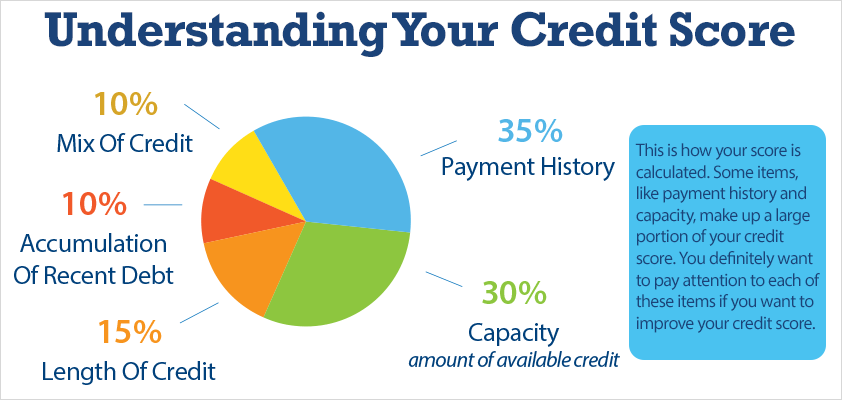

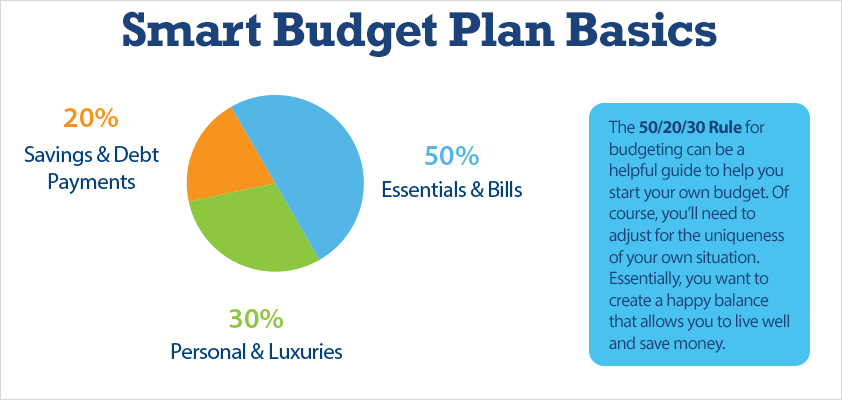

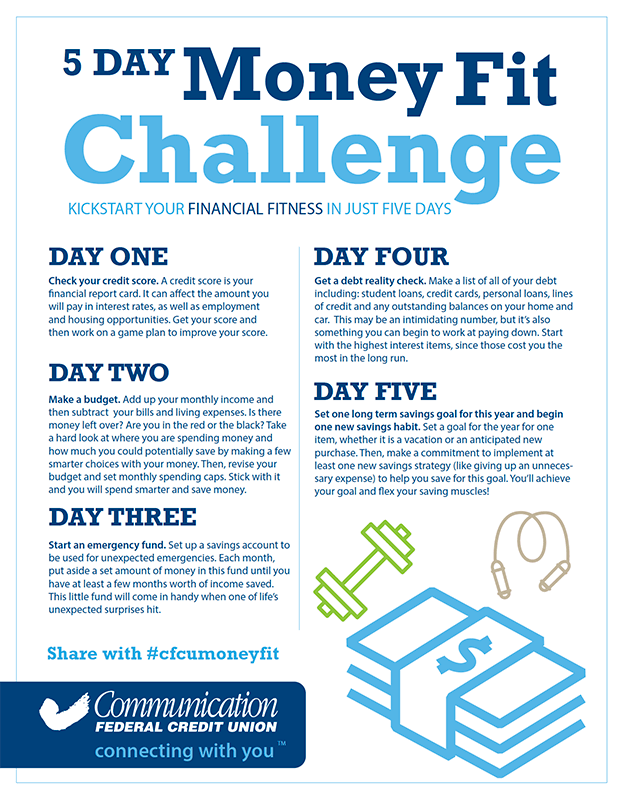

Money Fit Top Tips Communication Federal Credit Union

Once You Have A Business License Are You Able Apply For A Business Loan Quora

Exhibit9942016investorpr

Used Fiat Cars For Sale In Boston Ma Cars Com

How To Qualify For A Loan Tips For First Time Home Buyers

37 Key Rv Industry Statistics Trends Facts 2022 Data

How To Qualify For A Loan Tips For First Time Home Buyers

Is A Heated Driveway A Good Investment Driveway Repair Asphalt Driveway Heated Driveway

Land Loan Calculator And Lot Loans Macu

Money Fit Top Tips Communication Federal Credit Union

Management Page 3 The Bullvine The Dairy Information You Want To Know When You Need It

Money Fit Top Tips Communication Federal Credit Union